Contents:

Licensing a trade mark allows the company to take advantage of already-established goodwill and brand identification. Also, if there aren’t any or minimal sales or production, the lessor will be in a position of loss, and the lessee will pay the least amount of royalty. To avoid this kind of scenario, the lessee must pay an amount minimum, regardless of the amount of merchandise the lessor made or offered. For those granting the rights, it allows them to earn passive income and benefit from their invention, property, or ownership.

We deserve better: no artist should be in the dark about their … – Music Ally

We deserve better: no artist should be in the dark about their ….

Posted: Sun, 19 Mar 2023 07:00:00 GMT [source]

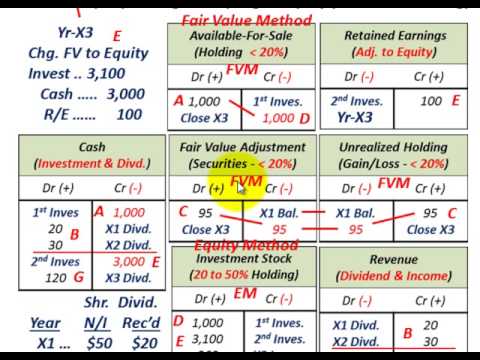

While the player piano made inroads deep into the 20th century, more music was reproduced through radio and the phonograph, leading to new forms of royalty payments, and leading to the decline of sheet music. An example from Canada’s northern territories is the federal Frontier Lands Petroleum Royalty Regulations. In this manner risks and profits are shared between the government of Canada and the petroleum developer. This attractive royalty rate is intended to encourage oil and gas exploration in the remote Canadian frontier lands where costs and risks are higher than other locations. For example, if royalty amount is 1,000,000/-& rate of TDS is 10%, then lessee will pay Rs. 900,000/- to lessor. Amount of royalty charge to profit and loss account will be Rs. 1,000,000/- and balance amount of Rs. 100,000/- will be deposited in the credit of central Government account.

b) When minimum rent account is opened

Main aim of this blog is to provide all academic resources and information’s especially for Commerce Stream Students. I am also working on some other websites which will be published soon. The industry standard Guaranteed Minimum Royalty is 50% of the projected sales for a given period.

If your earnings from copyrights, patents, or other types of rights put you just above the threshold and you enter a higher tax bracket, you must pay the higher rate. This is because the tax calculation revolves around the marginal percentage, which is the rate applied to the next dollar that you make. If you are paying royalties or licensing fees, these payments might fall under legitimatebusiness expenses. If the payments are for the purchase of property, the property becomes an asset on your business balance sheet, and the payments might need to beamortized. If you pay more than $10 in royalties in a year, you must give the payee a 1099-MISC form to show the total of your payments for the year.

In most European jurisdictions the right has the same duration as the term of copyright. Both interactive and non-interactive streaming services are required and regulated by the Copyright Royalty Judges to pay out a minimum fee per stream. Interactive services must pay out $0.0022 per stream while non-interactive streaming services must pay $0.0017 per stream. These rates are set to be what these services are required to distribute per stream and has been the rate since 1 January 2016 and will be reevaluated after 31 December 2020. There is also a separate organization in the UK called VPL, which is the collecting society set up by the record industry in 1984 to grant licenses to users of music videos, e.g. broadcasters, program-makers, video jukebox system suppliers. The licensing income collected from users is paid out to the society’s members after administrative costs are deducted.

Licensing Corporate Brands and Trademarks: Knowing What it Should Cost

The Federal Government receives royalties on production on federal lands, managed by the Bureau of Ocean Energy Management, Regulation and Enforcement, formerly the Minerals Management Service. A landowner with petroleum or mineral rights to their property may license those rights to another party. In exchange for allowing the other party to extract the resources, the landowner receives either a resource rent, or a “royalty payment” based on the value of the resources sold. When a government owns the resource, the transaction often has to follow legal and regulatory requirements.

Khatabook does not make a guarantee that the service will meet your requirements, or that it will be uninterrupted, timely and secure, and that errors, if any, will be corrected. The material and information contained herein is for general information purposes only. Consult a professional before relying on the information to make any legal, financial or business decisions.

Royalty Payment Accounting Example – Licensee

] organizations (see “Royalty Rate Websites” listed at the end of this article) who have comprehensive information on both royalty rates and the principal terms of the agreements of which they are a part. There are also IP-related organizations, such as the Licensing Executives Society, which enable its members to access and share privately assembled data. Apart from placing a levy on the resale of some art-like objects, there are few common facets to the various national schemes. Most schemes prescribe a minimum amount that the artwork must receive before the artist can invoke resale rights . Some countries prescribe and others such as Australia, do not prescribe, the maximum royalty that can be received.

PPL issues performance licenses to all UK radio, TV and broadcast stations, as well as establishments who employ sound recordings , in entertaining the public. The licensing company collects and distributes royalties to the “record label” for the sound recording and to “featured UK performers” in the recording. How, and to whom, royalties are paid is different in the United States from what it is, for example, in the UK. Most countries have “practices” more in common with the UK than the US. Royalty income is money that’s paid to you in exchange for the use of your property.

BUILD-A-BEAR WORKSHOP INC MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (form 10-K) – Marketscreener.com

BUILD-A-BEAR WORKSHOP INC MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (form 10-K).

Posted: Thu, 13 Apr 2023 20:04:06 GMT [source]

When a company reports royalty expense for a financial period, the result is a decrease in net income and thus a decrease in income tax liability. The tax liability gets transferred to the individual who earned the payment and received the Form 1099. The individual is then responsible for reporting the correct amount of royalty payments received for the year, as well as all personal business expenses related to the royalty income. Since royalties fall under the overall heading of “Compensation” they can be written off as an expense for each tax period. Royalty payment rates are outlined in a contract between the company and the individual being paid, and are therefore determined based on sales figures for the applicable product.

Bookkeeping

How to Obtain a Copy of Past Returns Prior year transcripts – who to call, which forms to fill out, etc.

Dr. Dre Sued By Producer Over Rights To Kendrick Lamar Song – The Blast

Dr. Dre Sued By Producer Over Rights To Kendrick Lamar Song.

Posted: Tue, 11 Apr 2023 17:43:16 GMT [source]

Depending on the structure of the agreement, music royalties can be among the highest-paying royalties, with an annual return on investment of approximately 12 percent, which may include a product license agreementfor branded products. A licensing agreement governs the terms and establishes the amount of royalties. It might be a per-unit payment for goods or calculated as a percentage of sales.

Short workings

This https://1investing.in/ is determined on the basis of number of goods produced or quantum of goods sold. Therefore, in case of a patent or a copyright, the publisher pays royalty to the author based on the number of book copies sold. In other words, the holder of the patent or copyright receives royalty based on the number of items sold by the user.

Harper, a singer has licensed his music to an online music retailer, Pentatonic. Pentatonic pays Harper $0.25 for every song of his sold through their website. In the first month, Pentatonic only sold five songs by Harper and wrote a check to Harper for $1.25. However, the next month, with the advent of Harper’s first hit song, “Wintergreen Love,” Pentatonic sells 10 million songs.

Special webcasting is a bookkeeping where the user can choose a stream of music, the majority of which comprises works from one source – an artist, group or particular concert. Permanent Downloads are transfers of music from a website to a computer or mobile telephone for permanent retention and use whenever the purchaser wishes, analogous to the purchase of a CD. Regulatory provisions in the US, EU and elsewhere is in a state of flux, continuously being challenged by developments in technology; thus almost any regulation stated here exists in a tentative format. In Australia and New Zealand, the Australasian Mechanical Copyright Owners Society collects royalties for its members. These exclusive rights have led to the evolution of distinct commercial terminology used in the music industry.

- To get rid of such a situation, the lessor requires a minimum amount of payment to be paid by the lessee irrespective of the number of goods produced or sold by the lessee.

- Royalty is a business expense and closed and transferred to profit and loss account.

- The landowner earns a profit without having to do the work, and the miner earns a profit without having to raise capital to buy land.

- As long as you are not a sole-proprietor who lives off the intangible rights, you will receive a form titled “1099-MISC” that shows your gross non-employee, miscellaneous earnings for the year.

In fact, this card is so good that our experts even use it personally. Click here to read our full review for free and apply in just 2 minutes. There are exceptions and nuances to all these rules, so if you have questions about royalties and taxes, make sure you consult a professional tax advisor. Intellectual property that has significant standalone functionality .

GAAP. Stakeholders are strongly encouraged to listen to feedback about this staff paper from TRG members and Board members during the TRG meeting and to read the meeting summary, which will be prepared by the staff after the meeting. Intellectual property is a set of intangibles owned and legally protected by a company from outside use or implementation without consent. These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license. Thanks to all authors for creating a page that has been read 127,347 times. Visit your attorney and request or demand an accounting as the case may be. If you are entitled to the royalties you are entitled to an accounting.

- Music royalties fall into four categories, including mechanical, performance, print, and synchronization.

- For the licensor, a royalty agreement to allow another company to use its product can allow them access to a new market.

- Again, please review this information with a tax advisor or attorney to ensure these details are appropriate to your individual situation.

- Like other legal business contracts, licensing and royalty contracts may vary based on state laws.

- Hence, Rs. 2,500 (Rs. 6,000 – Rs. 3,500) should be credited to Profit and Loss Account as the lease agreement provided that short-working could be recouped only within two following years in which the short-working occurred.

Topic 606 includes guidance for determining whether a license transfers to a customer at a point in time or over time based on the nature of the entity’s promise to the customer. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. SoftwareCo would recognize the $16,000 fee for the additional rights when it transfers control of the additional licenses. SoftwareCo would also recognize amounts allocated to the related material right, if any, at the time the right is exercised.

He has an agreement with Mine Company where the minimum rent is $10,00,000 and the royalty charged is $200 per ton of production each month. In 2019, the production was 3000 tons, in 2020 the production was 5000 tons, and in 2021, the production was 7000 tons. Publishers pay the author of the book royalties based on how many copies of the books were sold. There is an agreement in place that dictates how much royalty is to be paid to the author by the publisher. Royalties exist because they enable the owner to benefit from their work and their property. In a way, royalties can protect the owner of the property as they ensure the property is being used properly.